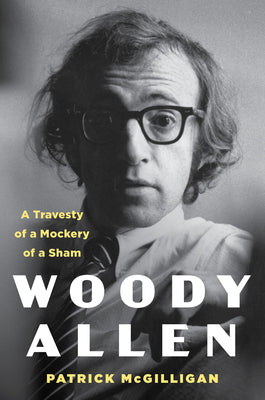

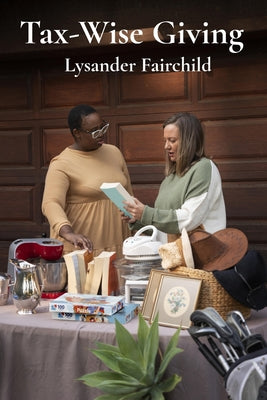

Tax-Wise Giving: Strategies for Charitable Gifting and Estate Planning Using Trusts and Gift Tax Exemptions for Philanthropic Impact

Tax-Wise Giving: Strategies for Charitable Gifting and Estate Planning Using Trusts and Gift Tax Exemptions for Philanthropic Impact

Fairchild, Lysander

Select Format

Tax-Wise Giving: Strategies for Charitable Gifting and Estate Planning Using Trusts and Gift Tax Exemptions for Philanthropic Impact provides a comprehensive guide to navigating the complex landscape of charitable giving while maximizing tax benefits and ensuring your legacy aligns with your philanthropic goals. This book is a crucial resource for individuals seeking to make a meaningful difference while optimizing their financial strategies.

This book begins by introducing the power of philanthropy and the fundamental tax principles that underpin effective giving. It walks you through initial planning steps, emphasizing the crucial alignment of your giving with both personal values and financial objectives. Learn how to strategically leverage various charitable giving vehicles, from direct gifts of cash and assets to donor-advised funds (DAFs) and private foundations, each with its own unique tax implications.

Unravel the complexities of trusts for charitable giving. Explore the nuances of charitable remainder trusts, charitable lead trusts, grantor retained annuity trusts, and other specialized charitable trusts. Gain a solid understanding of trust administration basics and the associated legal considerations, empowering you to make informed decisions.

Master the art of gift tax exemption planning to maximize your charitable impact. This book demystifies the annual gift tax exclusion and the lifetime gift tax exemption, providing clear guidance on navigating gift tax returns and minimizing potential liabilities. Discover proven strategies for integrating charitable giving seamlessly into your estate plan. Learn how testamentary gifts, strategic planning for retirement assets such as IRAs and 401(k)s, and thoughtful charitable bequests within your will can significantly reduce estate taxes while furthering your philanthropic vision.

Maximize your philanthropic impact by exploring innovative strategies like impact investing, which allows you to generate both social and financial returns. Gain practical knowledge on measuring the effectiveness of your charitable giving and ensuring your contributions achieve their intended purpose.

Through real-world case studies illustrating diverse scenarios - from high-net-worth individuals and small business owners to retirees planning their legacies and families engaging in collaborative giving - this book provides practical applications of the concepts discussed. Explore complex giving arrangements and gain insights into how to tailor your approach to your specific circumstances.

Tax-Wise Giving provides the knowledge and tools you need to navigate the intricate world of charitable giving with confidence. Empower yourself to make informed decisions that maximize your philanthropic impact while optimizing your financial well-being.

Give wisely. Plan strategically. Leave a legacy. Secure your copy today!

User reviews will be displayed here...

Related products or products you might find interesting

The Bible Recap: Deepen Your Understanding of God's Attributes from Every Book in the Old Testament

Cobble, Tara

$17.21 USD Shop Now

Window Shopping with Helen Keller: Architecture and Disability in Modern Culture

Serlin, David

$121.96 USD Shop Now

Tales from the Dancefloor: Manchester / The Warehouse Project / Parklife / Sankeys / The Ha

Lord, Sacha

$30.00 USD Shop Now